4 Easy Facts About Simply Solar Illinois Shown

4 Easy Facts About Simply Solar Illinois Shown

Blog Article

The 8-Minute Rule for Simply Solar Illinois

Table of ContentsMore About Simply Solar IllinoisSimply Solar Illinois for BeginnersThe Basic Principles Of Simply Solar Illinois The Definitive Guide for Simply Solar IllinoisThe smart Trick of Simply Solar Illinois That Nobody is Discussing

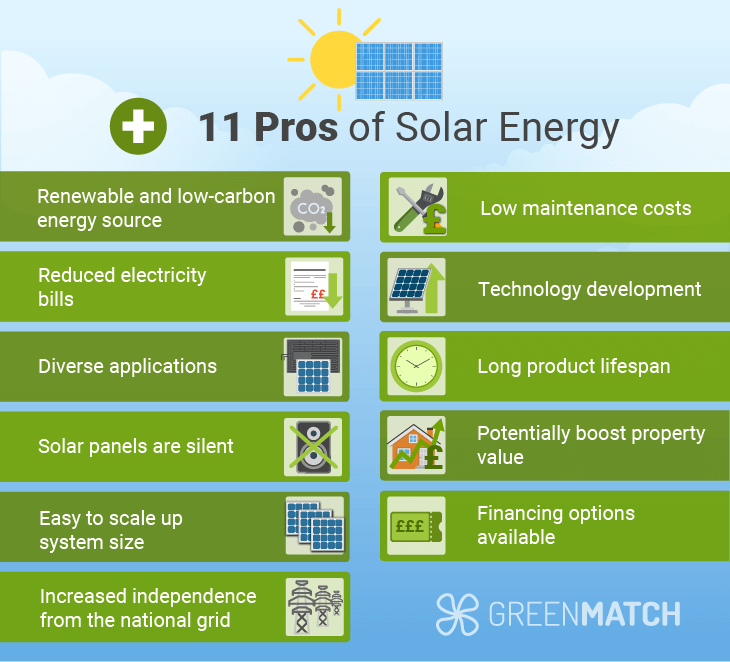

Our group partners with local neighborhoods across the Northeast and past to deliver clean, budget-friendly and reputable power to cultivate healthy neighborhoods and keep the lights on. A solar or storage job supplies a variety of benefits to the community it serves. As modern technology breakthroughs and the price of solar and storage space decrease, the economic benefits of going solar proceed to increase.Support for pollinator-friendly environment Habitat repair on contaminated sites like brownfields and land fills Much required color for livestock like lamb and chicken "Land banking" for future farming use and dirt top quality enhancements Due to environment change, severe weather is becoming extra constant and turbulent. As a result, property owners, organizations, neighborhoods, and energies are all becoming much more and much more interested in safeguarding power supply solutions that use resiliency and power safety.

Environmental sustainability is an additional crucial motorist for businesses buying solar power. Many firms have robust sustainability goals that include decreasing greenhouse gas discharges and using much less resources to assist reduce their influence on the all-natural setting. There is an expanding seriousness to deal with climate adjustment and the stress from customers, is getting to the leading levels of organizations.

The Only Guide to Simply Solar Illinois

As we approach 2025, the assimilation of photovoltaic panels in business jobs is no much longer simply an alternative but a calculated requirement. This blogpost digs right into how solar energy works and the complex benefits it brings to industrial buildings. Photovoltaic panel have been utilized on property structures for years, but it's just just recently that they're coming to be a lot more typical in business building and construction.

In this short article we discuss how solar panels job and the advantages of utilizing solar energy in commercial structures. Electrical power expenses in the United state are raising, making it a lot more pricey for organizations to run and more challenging to intend ahead.

The U - Simply Solar Illinois.S. Energy Info Management expects electric generation from solar to be the leading source of growth in the U.S. power field through the end of 2025, with 79 GW of brand-new solar capacity More Bonuses projected to find online over the next 2 years. In the EIA's Short-Term Power Expectation, the firm said it anticipates sustainable power's general share of electricity generation to increase to 26% by the end of 2025

Simply Solar Illinois Can Be Fun For Everyone

The sunshine creates the silicon cell electrons to instate, developing an electrical current. The photovoltaic solar battery soaks up solar radiation. When the silicon communicates with the sunlight rays, the electrons begin to move and create a circulation of straight electrical existing (DC). The cables feed this DC power into the solar inverter and convert it to rotating power (AC).

There are several ways to store solar power: When solar energy is fed right into an electrochemical battery, the chemical reaction on the battery parts keeps the solar energy. In a reverse reaction, the present departures from the battery storage for intake. Thermal storage space uses tools such as molten salt or water to keep and absorb the warmth from the sunlight.

Solar panels substantially decrease energy prices. While the first investment can be high, overtime the expense of installing solar panels is recouped by the cash conserved on electricity bills.

Rumored Buzz on Simply Solar Illinois

By installing solar panels, a brand name reveals that it appreciates the environment and is making an effort to decrease its carbon footprint. Buildings that depend completely on electrical grids are at risk to power blackouts that occur during bad weather or electrical system malfunctions. Solar panels installed with battery systems allow commercial buildings to continue to function during power outages.

The Facts About Simply Solar Illinois Uncovered

Solar power is just one of this the cleanest forms of energy. With durable warranties and a production life of approximately 40-50 years, solar investments contribute substantially to ecological sustainability. This shift towards cleaner power resources can lead to wider financial advantages, including decreased environment adjustment and ecological destruction expenses. In 2024, home owners can take advantage of federal solar tax rewards, permitting them to counter nearly one-third of the purchase price of a solar system with a 30% tax obligation credit scores.

Report this page